Introduction

SAFE Notes (Simple Agreement for Future Equity) are a financial instrument start-ups use to raise capital from investors. They are similar to convertible notes. Instead of accruing debt, investors receive the right to equity in the company at a future date, usually at the time of the company’s next financing round or liquidity event. SAFE Notes allow start-ups to raise capital without setting a valuation or price per share.

They have become a popular financing option for start-ups and investors due to their ease of use and lower legal and transaction costs. They were first introduced by Y Combinator, a start-up accelerator, in 2013 and have since become widely adopted in the start-up community.

What is the difference between SAFE Notes and Convertible Notes?

SAFE notes and convertible notes are financing instruments that are used in start-up funding rounds. While they share some similarities, there are also some key differences. Convertible notes determine the conversion price upfront, while a SAFE note does not have a conversion price at the time of investment. Convertible notes accrue interest and have a maturity date, while a SAFE note does not. Finally, convertible notes require more negotiation and have more terms, while SAFE notes are uncomplicated to set up. In summary, the choice between the two types of notes will depend on the specific needs and goals of the start-up and the investor.

When Should You Use a SAFE Note?

The decision on whether you should use a SAFE note or a Convertible note is dependent on various factors:

- Time – SAFE Notes are quicker and more straightforward than convertible notes. Further, they have fewer terms and conditions, streamlining the fundraising procedure.

- Valuation – SAFE Notes are preferred to be used in cases where the valuation of the start-up is challenging to determine or is uncertain. Since valuation is complex to determine in the early stages of a start-up, a SAFE note allows investors to defer valuation discussions to a later round of funding.

- Early start-up stages – SAFE Notes are commonly used at early-stage or seed-stage fundraising. This is because, at this stage, the start-up does not have a solid valuation or enough financial data. Convertible notes are more common at later stages.

SAFE Notes and Taxes

The tax treatment of a SAFE is unclear as there is no specific guidance. While new derivatives like SAFEs are typically assigned to multiple transaction categories, SAFEs do not fit neatly into any one category. Despite being similar to convertible notes, SAFEs do not have interest payments, repayment obligations, maturity dates, or other typical debt features. They also lack traditional equity rights like voting and dividend rights. However, their tax treatment can be similar to that of equity since they convert to equity at a later date.

When a company issues a SAFE to an investor, it is not considered income or revenue at the time of issuance or conversion. Therefore, it cannot be taxed as income. Instead, it is treated as a long-term liability on the company’s tax return since it represents an obligation to issue equity to the investor in the future. However, if the company has classified the SAFE as equity on its balance sheet, it would be disclosed as additional paid-in capital for tax disclosure purposes. This means the investment would be treated as a contribution to the company’s capital rather than a liability. Therefore, it’s important for companies and investors to accurately classify and disclose SAFEs for tax purposes to ensure compliance with relevant tax laws and regulations.

Therefore, when it comes to taxes, investors should be aware of the holding period for the safe notes, which will impact how they are taxed when converted into equity.

For convertible notes, the holding period begins when the note is purchased and continues until the note is converted into equity. Once the conversion occurs, the holding period is retroactive to when the note was issued. This means that if an investor holds a convertible note for more than one year before conversion, they may be eligible for long-term capital gains tax rates, which are generally lower than short-term capital gains tax rates.

For safe notes, the holding period begins when the note is used, which is typically when the note is converted into equity. As with convertible notes, if the investor holds the safe note for more than one year from the date of conversion, they may be eligible for long-term capital gains tax rates.

It’s important to note that the holding period for safe notes is generally longer than for convertible notes. This is because converting a safe note typically occurs later in the startup’s lifecycle when the company is more established and has a higher valuation. This means that the investor may need to hold the equity for a longer period before being able to sell it at a profit.

How do SAFE Notes work?

- A start-up and an investor agree to a SAFE Note as a financing instrument for the investor’s investment in the company.

- The investor provides funds to the start-up in exchange for the right to receive equity in the company at a future date or event.

- The start-up and the investor agree on a trigger event to determine when the SAFE note converts into equity. This trigger event could be a future equity financing round, an acquisition, or a specific date.

- The start-up and the investor agree on a valuation cap or a discount rate that will determine the valuation of the company at the time of conversion. The valuation cap is the maximum valuation at which the SAFE note can convert into equity, while the discount rate is a percentage discount applied to the valuation of the company at the time of the trigger event.

- The investor receives equity in the company at the predetermined valuation when the trigger event occurs, and the SAFE note converts into equity.

- The start-up and the investor may also agree on additional terms and conditions related to the SAFE note, such as rights and restrictions on the equity received by the investor, events of default, and other provisions.

Overall, the steps involved in how a SAFE Note works are relatively effortless compared to other financing instruments. The directness of SAFE Notes has made them a popular choice for early-stage start-ups that need to raise capital quickly and do not have the resources to negotiate complex financing agreements.

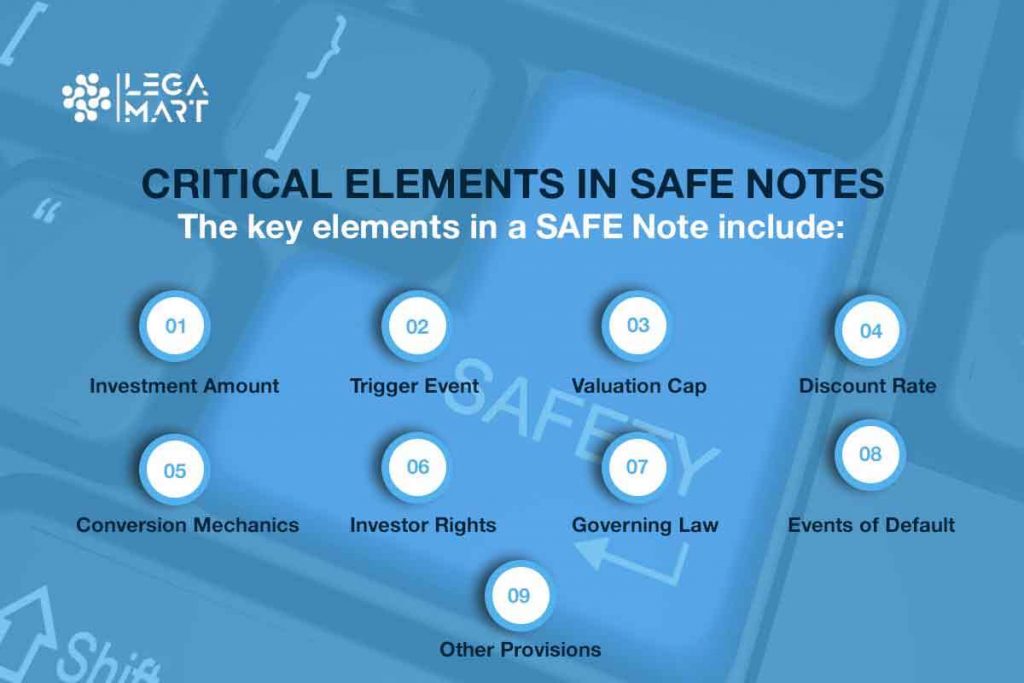

Critical Elements in a SAFE Notes

The key elements in a SAFE Note include:

Investment Amount: The amount of money the investor will invest in the start-up in exchange for the right to receive equity at a future date or event.

Trigger Event: The event will trigger the SAFE Note conversion into equity. This could be a future equity financing round, an acquisition, or a specific date.

Valuation Cap: The maximum valuation the SAFE note can convert into equity. This is typically used to ensure that the investor receives equity at a fair valuation, even if the company’s valuation has increased significantly since the investment.

Discount Rate: The percentage discount applied to the valuation of the company at the time of the trigger event. This is used to incentivize investors to invest early in the company’s development.

Conversion Mechanics: The mechanics of the conversion of the SAFE note into equity. This includes the percentage of equity the investor will receive at conversion, the type of equity (e.g., common stock or preferred stock), and any other terms and conditions related to the conversion.

Investor Rights: Any additional rights or restrictions the investor will have due to the investment. This could include voting rights, information rights, or anti-dilution protection.

Governing Law: The governing law will be used to interpret and enforce the terms of the SAFE note.

Events of Default: The events that trigger a default under the SAFE note. This could include the failure of the start-up to comply with certain covenants or the occurrence of a material adverse change in the start-up’s business.

Other Provisions: Any other provisions specific to the needs and goals of the start-up and the investor. This could include provisions related to intellectual property rights, non-disclosure agreements, or other matters.

Overall, the key elements in a SAFE Note are designed to help start-ups raise capital while protecting the investor’s interests. By providing a clear framework for converting the SAFE note into equity, as well as any additional rights and restrictions, start-ups and investors can work together to achieve their shared goals of growth and success.

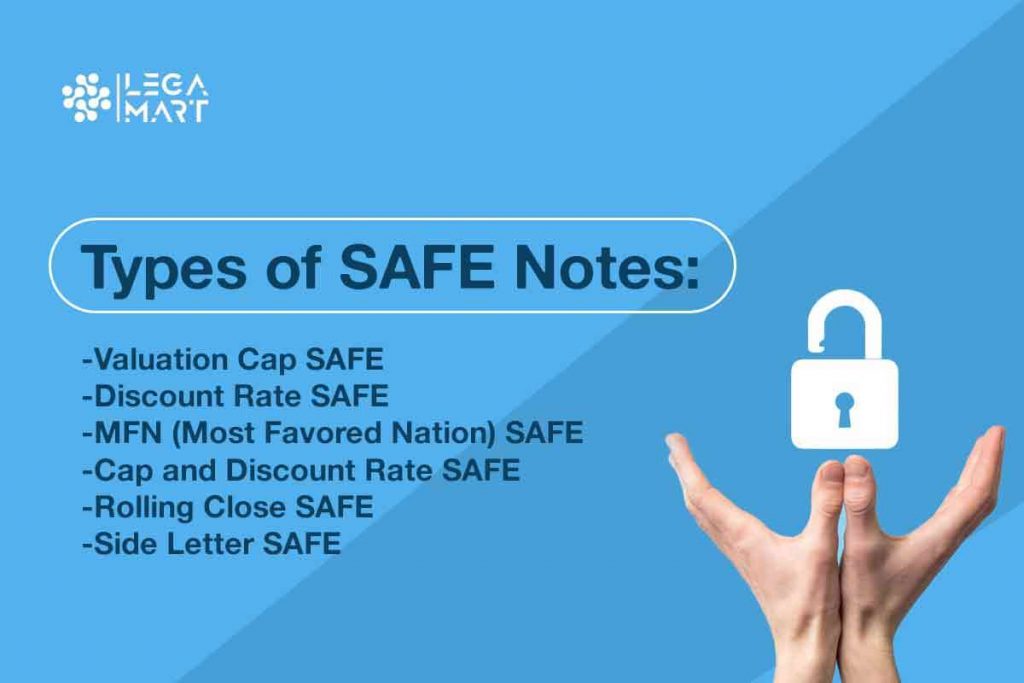

Types of SAFE Notes

There are several types of SAFE Notes, each with unique features and benefits. Here are some of the most common types of SAFE Notes:

Valuation Cap SAFE: This type of SAFE note includes a valuation cap, which sets a maximum valuation for the company at the time of conversion. This ensures that the investor receives a fair valuation for their investment, even if the company’s valuation has increased significantly since the investment.

Discount Rate SAFE: This type of SAFE note includes a discount rate, which gives the investor a discount on the company’s valuation at the time of conversion. This encourages early-stage investment by providing investors with a financial incentive to invest in the company at an early stage.

MFN (Most Favored Nation) SAFE: This type of SAFE note includes a clause that ensures the investor will receive the most favourable terms available if the company issues additional equity to other investors. This can be a useful way to protect the investor’s investment and ensure they receive a fair deal.

Cap and Discount Rate SAFE: This type of SAFE note includes a valuation cap and a discount rate. This provides the investor with additional protection against a significant increase in the company’s valuation between the time of investment and the time of conversion.

Rolling Close SAFE: This type of note allows the company to close multiple investment rounds using the same SAFE note. This can be a useful way for the company to raise capital over time while minimizing legal and administrative costs.

Side Letter SAFE: This SAFE note includes additional provisions negotiated between the company and the investor outside the main SAFE Note agreement. This can be a useful way to address specific concerns or requirements of the investor that are not covered by the main SAFE Note agreement.

Each type of SAFE note is designed to meet the specific needs and goals of the company and the investor, by understanding the different types of SAFE Notes available, start-ups and investors can choose the option that best fits their needs and objectives.

Accounting for SAFE Notes

When a company issues a SAFE note, it does not record the note as debt on its balance sheet. This is because a SAFE note does not have a fixed interest rate, maturity date, or repayment schedule like traditional debt instruments such as bonds or loans. Instead, a SAFE note represents a right to purchase equity in the company at a future date, typically when the company raises its next round of financing or goes public.

As a result, investors typically expect companies to classify SAFE notes as equity on their balance sheets. This is because the value of a SAFE note is tied to the future value of the company, much like equity investments, i.e. SAFE notes do not have a maturity date, they are not required to be paid back within a specific timeframe and remain on the balance sheet as equity until certain events occur, such as the company being sold or raising additional capital. In contrast, debt investments represent a fixed obligation that must be repaid to the investor.

Therefore, from an accounting standpoint, treating SAFE notes as equity rather than debt has several implications for a company’s balance sheet. Equity investments are typically recorded in the equity section of the balance sheet, which includes items like common stock, preferred stock, and retained earnings. This means that SAFE notes will be included in the equity section alongside other equity investments.

Additionally, because SAFE notes are not recorded as debt, they do not have an impact on a company’s debt-to-equity ratio. This is an important financial metric that measures the proportion of a company’s financing from debt versus equity. Since SAFE notes are classified as equity, they are not included in the debt portion of the ratio.

Thus, it is important for companies and investors to understand the accounting treatment of SAFE notes as equity investments. This classification has implications for a company’s balance sheet and financial metrics, and it reflects the unique nature of these instruments as a hybrid between debt and equity.

SAFE Notes and Valuation

Valuation Cap for SAFE notes

Convertible notes and SAFEs are two types of capital-raising instruments that can be converted into shares of a company in the event of a specified trigger event, such as a future financing round. Convertible notes operate as a debt, which changes into shares when a trigger event occurs, while a SAFE functions as a capital-raising vehicle, which converts into shares when a future financing round happens. Both instruments commonly feature investor-friendly terms like a discount and a valuation cap. A valuation cap is a limit placed on the valuation of the company, which allows investors to acquire equity at a discounted price in future rounds of funding. If there is no valuation cap or markdown, the instrument will convert into stock at the current price.

SAFE notes do not offer interest rates, maturity dates, or default exit dates, which may lead to investors seeking a higher conversion discount or lower conversion cap. It is important to negotiate when dealing with SAFE notes, and investors should aim for a lower cap or higher discount. The negotiation should consider the overall gains and losses and the comparison with the benefits of convertible notes.

To calculate the valuation cap for a SAFE note, divide the valuation cap by the typical equity financing valuation and subtract that value from one. This is the mathematical formula for determining the SAFE discount. Negotiating the value cap is usually the only thing required when closing a deal with a SAFE. The cap can be established based on the amount of risk an investor is willing to assume, which may be influenced by factors such as a proven product or incorporation.

Types of Valuation cap SAFE notes

Below are the various types of Safe notes with valuation caps used to analyze capital market prices and their use.

- Safe with a valuation cap but no discount: here, the valuation cap sets the maximum price at which the investor can convert their investment into equity. For example, if an investor purchases a SAFE for $100,000 with a valuation cap of $8 million and the company later raises funding at a pre-money valuation of $10 million, the investor would be able to convert their investment into equity at a valuation of $8 million, rather than $10 million. However, there is no discount applied to the conversion price.

- Safe with a discount but no valuation cap: this type offers a discount to the investor upon conversion to equity but does not have a predetermined valuation cap. The discount is typically calculated based on the price per share in the next equity financing round. This type of SAFE may be attractive to investors who believe that the company’s valuation will increase significantly before the next financing round, as they will benefit from the discount.

- Safe with a valuation cap and a discount: Convertible securities usually have a discount at the time of conversion, and the valuation cap sets the highest price for conversion. The investor can choose either the discount or the value cap, whichever is more advantageous.

- Safe with no valuation cap and no discount: Some investors find valuation caps inconvenient, and selling a convertible note eliminates the need to determine the company’s value. If the cap reflects the current value, the founders may get bogged down in the valuation negotiation.

Pre-Money and Post-Money SAFE Note

As the name suggests, pre-money and post-money refer to when SAFE is converted into equity. In the case of a pre-money SAFE, the conversion is made prior to a new funding round, and hence, the valuation of the company is decided before the conversion. In a post-money SAFE, on the other hand, the conversion of SAFE into equity is done after the new funding round. Hence, the valuation of the company is decided after the SAFE conversion.

Pre-money SAFEs are seen as extremely challenging since they can lead to disagreements and confusion between the investors and the start-up about the valuation of the company. This is because valuation is determined before SAFE conversion, making it difficult to agree on the terms of conversion and the price of conversion.

Post-money SAFE also faces the issue of significant dilution of the existing shareholders. Since the conversion price is based on a higher valuation of the company, it gives rise to the possibility of the existing shareholder owing a smaller share in the company. Further, post-money SAFE tends to be less attractive to investors due to the lack of protection against dilution.

It is essential for the start-ups to consider both challenges before making any decision.

Advantages of using SAFE Notes

There are several advantages to using SAFE Notes for start-ups and investors. Here are some of the key benefits:

Simplicity: SAFE Notes are designed to reduce the time and cost of negotiating and drafting complex legal agreements. This makes it easier for start-ups to raise capital and investors to invest in start-ups.

Flexibility: SAFE Notes are adaptable in terms of the trigger event, valuation cap, and discount rate, which allows start-ups and investors to customize the terms of the investment to meet their specific needs and goals.

Reduced Dilution: Since SAFE Notes do not have an interest rate or maturity date, they can help reduce dilution for early-stage investors. This is because they do not require start-ups to pay interest on the investment or repay the principal, which can reduce the need for future financing rounds.

Protection: SAFE Notes can include investor protections, such as information rights, anti-dilution provisions, and most favoured nation clauses, which can help protect the interests of investors and ensure that they receive a fair return on their investment.

Speed: Since SAFE Notes do not require extensive legal documentation, they can be executed quickly, which can be particularly beneficial for start-ups that need to raise capital quickly.

Lower Legal Costs: Compared to traditional equity financings methods, such as convertible notes or preferred stock, SAFE Notes can have lower legal costs as they reduce the need for extensive legal negotiations and documentation.

Overall, the advantages of using SAFE Notes make them an attractive option for start-ups and investors looking for a simple, flexible, and cost-effective way to raise capital and invest in start-ups.

Challenges of using SAFE Notes

While there are several advantages to using SAFE Notes (Simple Agreement for Future Equity), there are also some challenges and drawbacks. Here are some of the key challenges of using SAFE Notes:

Uncertainty: Since SAFE Notes do not specify a valuation or price per share, the amount of equity the investor will receive during the conversion can be uncertain. This can make it difficult for investors to determine the potential return on their investment.

Lack of Control: SAFE Notes do not give investors voting rights or control over the company’s decision-making process. This can be a disadvantage for investors who want to have a say in how the company is run.

Conversion Timing: The conversion timing from a SAFE Note to equity can be uncertain, making it difficult for investors to plan their exit strategy or assess the potential return on their investment.

Tax Implications: The tax implications of a SAFE Notes can be complex, particularly if the company is sold or goes public before the SAFE note is converted to equity. Depending on the investment structure, investors may be subject to capital gains taxes or other taxes.

Limited Investor Protections: While SAFE Notes can include certain investor protections, they are generally less comprehensive than other forms of financing, such as preferred stock or convertible notes. This can leave investors with less protection in a downside scenario.

Lack of Industry Standardization: Since SAFE Notes are a relatively new form of financing, there is a lack of standardization in terms and provisions included. This can make it difficult for investors to compare different investment opportunities and assess the potential risks and rewards.

While SAFE Notes can be a valuable tool for start-ups and investors, they have some limitations and challenges that should be carefully considered before entering an investment agreement. Therefore, it is important for both parties to fully understand the terms and potential risks involved in a SAFE Note investment and to seek professional advice if necessary.

How to prevent the SAFE Notes problem?

While there are some challenges associated with investing in SAFE Notes, there are several steps that both start-ups and investors can take to prevent potential problems:

Do Your Due Diligence: Before investing in a SAFE Note, investors should carefully research the start-up and its founders to ensure they have a solid business plan, a clear path to profitability, and a strong management team. Investors should also review the terms of the SAFE note carefully to ensure that they understand the potential risks and rewards of the investment.

Work with Experienced Advisors: Start-ups and investors should work with experienced advisors, such as attorneys and accountants, who can guide them on a SAFE Note investment’s legal and financial implications. These professionals can help ensure that the investment is structured properly and that both parties are protected. Hence, you should consult a legal expert to understand better.

Customize the Terms: Start-ups and investors should work together to customize the terms of the SAFE note to meet their specific needs and goals. This can include setting a realistic valuation cap and discount rate, as well as including investor protections, such as information rights and anti-dilution provisions.

Consider Other Financing Options: While SAFE Notes can be useful for raising capital, they may not be the best option for all start-ups or investors. Start-ups should consider other financing options, such as convertible notes or traditional equity financing, to determine which option best meets their needs. Similarly, investors should consider other investment opportunities to ensure that they are diversifying their portfolios.

Communicate Openly and Transparently: To ensure no surprises or misunderstandings, start-ups and investors should communicate openly and transparently throughout the investment process. Start-ups should provide regular updates on their progress and financial performance, while investors should ask questions and seek clarification if they have any concerns.

By taking these steps, start-ups and investors can help prevent potential problems and ensure that their SAFE Note investment is structured properly and meets their needs and goals.

Common Misconceptions About SAFE

- No dilution – It is often believed that SAFE Notes do not result in the founder dilution. While it is true that there is no immediate equity exchange, once the conversion is triggered, there remains a possibility of the founder’s ownership dilution.

- No maturity date or interest – Another common misconception about SAFE Notes is that they do not involve any maturity dates or interest payments. While there is no explicit maturity date or interest payments, conversion triggers determine when investments are converted into equity.

SAFE to Keep It Simple Security (KISS)

Often known to be a mix of SAFEs and Convertible Notes, KISS is another way for start-ups to raise capital from investors. One of the main differences between SAFE and KISS is that KISS is inclusive of automatic participation rights in a company’s future equity rounds, a ‘most-favoured-nation’ clause, and additional liquidation preference rights. The addition of these terms makes it more investor-friendly. Further, they can be structured as debt through the inclusion of a repayment obligation with interest.

Conclusion

In conclusion, due to their simplicity and flexibility, SAFE Notes have become a popular financing option for start-ups and investors. While some challenges are associated with SAFE Notes, such as uncertainty around valuation and timing of conversion, they offer several advantages, including lower legal and transaction costs and fewer investor protections. Start-ups and investors should carefully consider the potential risks and rewards of a SAFE Note investment and work together to customize the terms to meet their specific needs and goals. A well-structured SAFE Notes can create a win-win scenario for start-ups and investors.

Frequently Asked Questions

Are SAFE notes Liability or Equity?

A SAFE note does not represent a traditional debt instrument as it lacks a fixed interest rate, maturity date, or repayment schedule. Instead, it is a right to purchase equity in the company at a future date. Therefore, companies should classify SAFE notes as equity rather than debt on their balance sheets, and venture capitalists and other investors expect them to do so. This has implications for a company’s financial metrics, including the debt-to-equity ratio, which is not impacted by SAFE notes since they are classified as equity. Overall, the accounting treatment of SAFE notes reflects their unique hybrid nature between debt and equity.

Do SAFE notes expire?

SAFEs, or Simple Agreements for Future Equity, are not considered debt instruments since they do not have a fixed interest rate, repayment schedule, or maturity date. As a result, they do not come with a predetermined expiration or maturity date, unlike traditional debt instruments such as bonds or loans. This means that investors may have to wait long before converting their SAFE notes to equity, even if the company has reported profits.

What if a SAFE note never converts?

If a SAFE note never converts, the company has not raised another round of financing, gone public, or been acquired, and the investor cannot convert their investment into equity. In this scenario, the terms of the SAFE contract will typically dictate what happens to the investor’s investment. In some cases, the investor may be able to negotiate repayment of their investment, either in cash or through some other form of compensation. However, in most cases, the investor will lose the funds they invested in the company using a SAFE.