Introduction

You started a business from scratch. You evolved from a small startup to a big company. You come across a project concept that is out of your league. How can you handle this situation?

You can form a legally binding joint venture agreement with an organization that can execute your project concept but does not have the resources or machinery to do it. This alliance will take both organizations to another level.

Sounds interesting?

However, the question would arise: What is this agreement that binds the whole working strategy between two big companies? This article explores the basics of a joint venture agreement and how you can ensure a definitive, legally binding joint venture agreement.

This article will also break down the essential clauses in a legally binding joint venture agreement and the importance of this agreement. It also sheds light on the integral factors to be considered while drafting the joint venture agreement.

What is a joint venture agreement?

A joint venture (JV) Agreement is a cooperation between two or more parties to perform a specific project or assignment. As part of the agreement, the parties share their resources, including but not limited to the capital, physical equipment, facilities, or Intellectual Property such as trademarks, patents, or copyrights.

It is an arrangement where two or more people collaborate to run a business. A joint venture can take many forms, such as equity-based or contractual joint ventures. The agreement can be for an extended time concerning the running of the business forever or on a finite period basis, depending upon the fruition of a specific project concept. It may involve forming an altogether new venture or a business positioned to benefit from the unification of the new party.

Unlike other agreements, JV is quite adaptable based on the need. Therefore, it will depend highly on the number of resources or desires of the parties concerned. It shows that a joint venture is the foundation of a coalition between two or more parties where the assets of the involved partners are transferred, leading to significant progress.

Advantages and disadvantages of joint venture

Advantages

A joint venture may help firms develop quicker, be more productive, and earn more income while maintaining corporate efficiency and budget.

Decreased financial burden

Each corporate entity may contribute a set amount of money to the business endeavor, assisting in cost reduction. A joint venture may lower each company’s financial burden and simplify the distribution of corporate resources.

Increased technical knowledge

Both sides may cover technical knowledge gaps and make the basis solid. Businesses may move quickly toward their goals and make daring movements in the market because they collaborate and have specialized expertise.

Increased market coverage

Businesses do not have to spend additional money updating their inventory or in-house assets. This is because when they enter a joint venture, they access more resources that cover their increased commercial needs.

Synergy benefits

Joint ventures, like other types of collaborations, provide synergistic advantages. Businesses could collaborate to increase operational efficiency or cut the cost of capital acquisition via mergers.

Disadvantages

Although there are various advantages to joining joint ventures, there are also some disadvantages. Here is a summary of the disadvantages of going into joint venture agreements:

Multiple objectives

A partner may pursue business goals that vary from those established under the joint venture agreement. This is a significant danger, and when two parties disagree, it may undermine collaborative company processes.

Expertise disparity

One company may believe it is contributing excessively to the joint venture agreement. It is critical to address how resources are shared and profit distribution. Clear communication is essential for success, and each party must understand what it can and cannot do to adhere to the agreement. The venture’s risks and benefits must also be discussed between the two firms.

Market conditions changes

Changes in market circumstances may cause joint ventures to collapse fast. This is unpredictability, but it is necessary to conduct business together. Economic policy shifts or market downturns may be unavoidable. A contract may also be dissolved at any moment and without justification by any side.

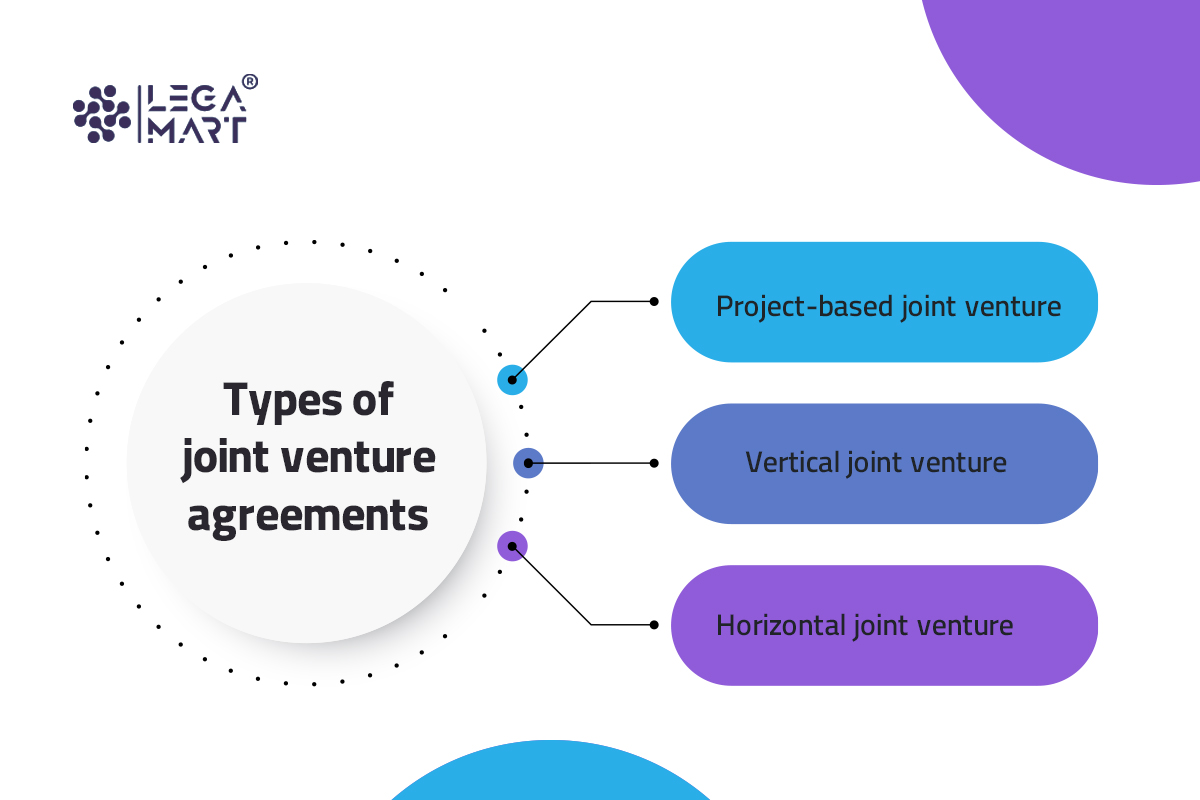

Types of joint venture agreements

Project-based joint venture

The partners in a Project-Based Joint Venture collaborate to complete a specific assignment. Because these partnerships are generally done for a specific reason, they are terminated after the project ends. These collaborations exist for a specific activity, project, or period.

Vertical joint venture

The transaction in this joint venture is between the customers and the suppliers. It is called bilateral trade since it is not an economically feasible choice. Different production phases of a single product are integrated into such joint ventures to produce economies of scale that decrease the per-unit cost of the completed product. This kind of joint venture is often quite successful. The buyer-supplier connection is also still strong. The company thrives, and high-quality goods are available to customers at an affordable price.

Horizontal joint venture

Companies dealing in/selling comparable items and direct rivals in the market join together to develop an output accessible by clients of either party. Disputes often emerge in this JV since both firms engage in identical/similar industries. The parties are also subjected to opportunistic conduct from one another.

The benefits of this partnership are distributed by the parties’ agreement. Such undertakings are unsatisfying because, despite collaboration, a sense of bitterness remains.

What is the purpose of creating a joint venture agreement?

Forming a legally binding joint venture with an ideal business partner provides a fast way to influence complementary resources available to form a better partnership, share each other’s skills, access the new market, or diversify into new business.

Some of the disadvantages faced by big conglomerates are when they find it hard to achieve the expectations in the global market in terms of product quality, technology, infrastructure, management process etc. A strong partnership between companies possessing varying expertise and capabilities in technology, marketing, distribution, etc., is essential to meet the needs of modern businesses.

What details should be provided in a written joint venture agreement?

Now that all stages are clear, it is time to shine a light on the main critical clauses that shall be inserted in any legally binding joint venture agreement:

Essence of the association: One of the essential purposes of the joint venture agreement is to clarify the nature of the relationship between the joint venturers. One part of this is whether the parties are under any fiduciary obligations to one another or it is purely a contractual association where the parties stay within the defined limits.

Parties’ contributions: Clarifying the parties’ contribution to the agreement. It ensures that each party understands what it is that they are committing to and ensures that that commitment binds them.

Sharing of profits, risks, and liability: Defining how the profits, risks, and liabilities will be shared between the parties.

Control Issue and Decision Making: Defining who manages the venture and handles its day-to-day operations.

Intellectual property: This point addresses preventing the exploitation of a venture’s intellectual property for its gain. A joint venture agreement must specify who will be the proprietor of any recently developed intellectual property devised by the business venture and the scope to which the parties may utilize that IP outside the venture.

Other clauses: The agreement should contain various provisions, including restriction on the sale of shares, installation of plant & machinery, maintenance facilities, dispute resolution mechanism, etc.

What makes joint venture agreements different from partnership agreements?

In the world of business and commerce, collaborations and partnerships are essential for growth and expansion. Two common forms of such collaborations are joint venture agreements and partnership agreements. While these agreements may seem similar on the surface, they have distinct differences that are crucial for businesses to understand.

Formation and Legal Basis

The primary difference between joint venture and partnership agreements is their legal basis and formation. Partnership agreements are established under specific legislative rules, which vary by jurisdiction and dictate rights, responsibilities, profit-sharing, management, and liability for partners. In contrast, joint venture agreements lack specific legislative rules, with rights and obligations primarily determined by the agreement’s terms and conditions.

Eligibility and Parties

Another significant difference pertains to the eligibility of the parties involved. Partnership agreements can only be formed by natural persons. In contrast, joint ventures do not have such eligibility restrictions. They can involve natural persons, legal entities, or a combination. This flexibility allows joint ventures to include a broader range of participants, such as corporations, limited liability companies, and individuals. This makes joint ventures a more versatile choice for business collaborations.

Force Majeure

Force majeure clauses are an essential component of joint venture and partnership agreements, but they are interpreted differently in each context. In the case of joint venture agreements, force majeure events refer to incidents or conditions beyond the control of a party involved in the joint venture.

This concept is based on the principle of impossibility as outlined in Section 56 of The Indian Contract Act of 1872. It provides a degree of protection for joint venture parties when unforeseeable events hinder the agreement’s execution. In contrast, partnership agreements do not typically have such explicit force majeure provisions, relying more on general partnership law.

Restrictive Covenants

- Non-Competition: Non-competition clauses play a crucial role in both partnership and joint venture agreements, serving to promote good faith and safeguard the parties’ interests. These clauses limit one party’s ability to enter a similar business for a specified time and within a defined geographic area. They are regulated by Section 27 of The Indian Contract Act of 1872 and Article 19 of the Indian Constitution, ensuring fairness and preventing undue burden in such restrictive covenants.

- Confidentiality: Confidentiality provisions are critical in both partnership and joint venture agreements. They define the terms and circumstances surrounding sensitive information and specify which information cannot be disclosed by any party. These provisions safeguard the intellectual property, trade secrets, and proprietary information of the parties involved.

Indemnity

Indemnity clauses in agreements protect parties from losses caused by the actions of the other party or third parties. In joint venture agreements, indemnity contracts are governed by Section 124 of the Indian Contract Act of 1872. This section outlines the legal framework for indemnity in India, covering implied and expressed indemnity. Partnership agreements also utilize indemnity clauses, but the legal framework for indemnity in partnerships is often more complex due to the specific rules and regulations governing partnerships.

Selection of Law and Jurisdiction

In choosing applicable law and jurisdiction for dispute resolution, joint venture agreements offer flexibility, allowing parties to select governing laws. However, fundamental contract law principles still apply, and specific business regulations like FEMA and taxation may also be relevant in India. In contrast, partnership agreements are subject to more stringent regulations, often tied to specific partnership laws and regulations in their respective jurisdictions.

Termination Clause

The termination clause in agreements defines the circumstances under which the agreement may be terminated. In a joint venture context, it is essential to note that the term “determinable contract” signifies a deal that can be terminated. Therefore, all revocable deeds and voidable contracts fall within this definition, as established in the case of Turnaround Logistics (Pvt.) Ltd v. Jet Airlines (India) Ltd by the Delhi High Court. In contrast, partnership agreements may have different rules governing their termination, which can vary based on local partnership laws and the terms specified in the agreement.

Conclusion

A well-structured and legally binding joint venture agreement is indispensable for any collaborative business endeavor. This pivotal document not only outlines the roles, responsibilities, and contributions of each party involved but also acts as a safeguard against potential disputes and uncertainties that can arise throughout the joint venture.

A meticulously crafted joint venture agreement is not just a contractual formality but a strategic instrument that empowers parties to navigate challenges, capitalize on opportunities, and confidently achieve shared objectives. Through effective communication, meticulous planning, and legal expertise, a robust joint venture agreement lays the foundation for a prosperous and enduring collaborative venture.

Frequently asked questions

What happens if one party wants to exit the joint venture?

The joint venture agreement should outline the process for a party’s exit, which could involve procedures for transferring ownership, selling shares, or other agreed-upon mechanisms. The agreement should also address how assets, liabilities, and responsibilities will be divided upon exit.

Can a joint venture agreement be terminated early?

Yes, a joint venture agreement can be terminated early if all parties involved agree to it or if certain triggering events specified in the agreement occur. These events could include breach of contract, bankruptcy, or other predefined circumstances.