- Introduction

- What is a Letter of Credit?

- Parties involved in a Letter of Credit

- How Does a Letter of Credit Work?

- Why is an LC Significant?

- What are the Features/Characteristics of LC?

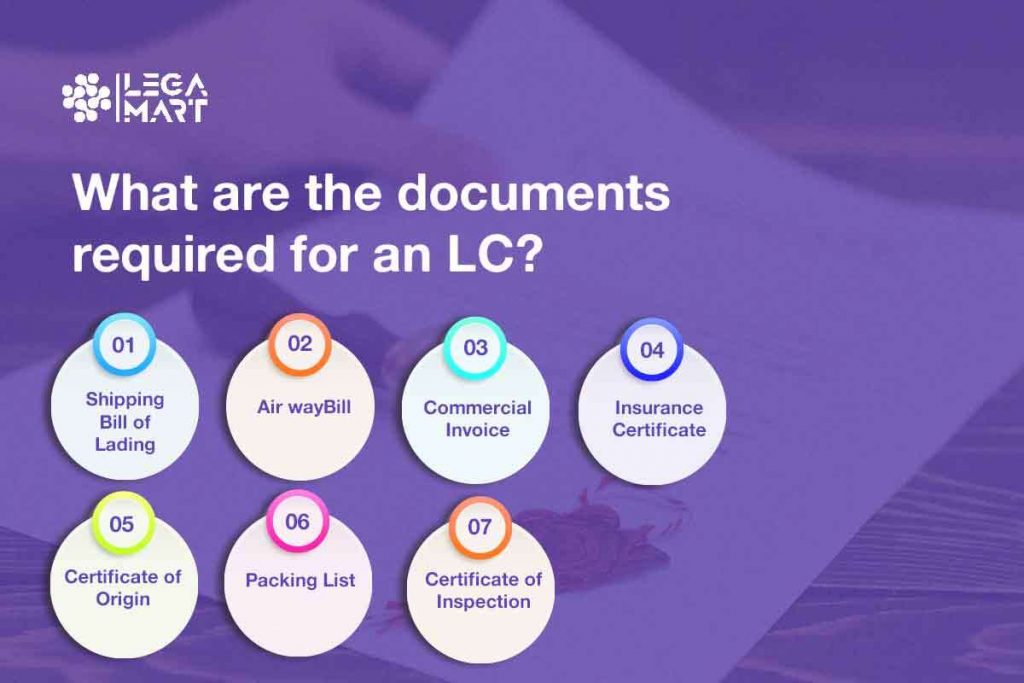

- What are the Documents Required for an LC?

- What are the Fees Payable for an LC?

- What are the Types of Letters of Credit?

- What are the Advantages and Disadvantages of an LC?

- Conclusion

- Frequently Asked Questions (FAQs)

Introduction

Adam started a new dropshipping business with low capital but encountered rejection as merchants wanted to avoid engaging in trade with someone without credibility in the market. Many new and established players wish to enter the market but cannot do so because of this.

Several tensions emerge when consumers and merchants worldwide get into maritime business procedures. Some of these tensions circle deferred payments, sluggish deliveries, and financing-related problems, among many others. The mere distances in multinational trade, diverse regulations and rules, and varying political landscapes are some grounds for sellers requiring a promise of payment when they deliver goods via the maritime route to their vendors.

To resolve this issue, letter of credit were presented by including the third party, like an economic establishment in the transaction, to mitigate credit risks for exporters.

This article aims to assist you in gaining in-depth knowledge and a detailed guide on what an LC is, how it works, why it is significant, documentation and fees, and types of LC. However, if you need legal help, you can always consult an attorney through a legal-tech platform like LegaMart, which has +2000 lawyers, out of which you can select a lawyer per your requirements at a minimal cost.

In layman’s terms, an LC is a bank service that ensures that the amount indicated to the vendor per instructions by the consumer, as well as the renditions of other requirements stipulated in the LC, are paid to him.

After this requirement is achieved, in the scenario that a transfer of ownership has occurred for the goods shipped by the vendor to the consumer and the submissions of the appropriate records corroborating the fulfilment of additional requirements of the LC is done, the issuer, in this case, the bank, will securely transfer the funds to the vendor’s checking account.

What is a letter of credit?

An LC is a written document issued by the importer’s bank (the opening bank) on the importer’s behalf. Through its issuance, the vendor is assured that the issuing bank takes full guarantee to compensate the exporter for the multinational trade between both groups.

In this case, the consumer applies for the LC, while the vendor is the claimant. In an LC, the bank issuing the funds takes complete accountability and pledges to settle the defined payment per the approved timeline and against prescribed records.

A significant regulation that comes into play while applying for an LC is that the bank issuing the funds will fulfil the amount based exclusively on the records presented during the application, and they are not mandated to dispatch the goods themselves on the ground corporeally. If the records surrendered during the application agree with the terms and requirements laid down in the LC, the bank will have no excuse to reject the compensation it is obligated to provide.

Important Terminologies

Issuing Bank – The bank issuing the LC on behalf of the buyer. This is the bank responsible for ensuring that the terms and conditions of the LC are met.

Applicant/Buyer – The party applying for the LC and agreeing to pay the amount specified.

Beneficiary/Seller – Also called the exporter, the party receives the payment from the issuing bank once the terms and conditions of the LC have been met.

Uniform Customs and Practice for Documentary Credits (UCP) – A set of international rules which govern the use of LC in international trade.

Who are the parties involved in a letter of credit?

The following parties assist in the entire LC transaction:

- Accepting Bank. This is the bank issuing the LC (issuer bank). The Accepting Bank commits to pay the face amount at maturity to anyone who presents them with the maturity document.

- Advising Bank. This is the bank to which the issuer bank forwards the LC, with instructions to notify the Exporter (Beneficiary).

- “Available with” Bank. This is the bank authorized to negotiate the LC or effect payment under the LC.

- Confirming Bank. This is the bank which, at the request of the issuer bank, provides the LC with a confirmation.

- Drawee Bank. This is the bank which is named in the LC. On this bank’s name, the drafts are drawn, and once the drafts are accepted, the Drawee Bank becomes the Accepting Bank.

- Beneficiary/Seller/Exporter. The party that sells the goods under the contract.

- Applicant/Buyer/Importer. The party that buys the goods under the contract.

How does a letter of credit work?

Usually, an LC is utilized in multinational trade to indicate that the payment will be completed to the vendor on time and in full, as insured by a bank or financial institution. After dispatching an LC, the bank will charge a fee, generally a portion of the LC, in addition to mandating collateral from the consumer.

To better understand how an LC works, consider the following example: Let us presume that John, a vendor with experience in dealing with times of economic crises, will think twice before giving credit to any consumer, be it a highly experienced one. In such a situation, the consumer can simply apply for an LC. Here, a bank, let’s name it ABC, would issue this consumer an LC within two business days, in which a Bank of ABC department would guarantee the purchase to John. Because the bank and John have an existent connection, the bank is acquainted with the buyer’s trustworthiness, investments, and economic situation.

While obtaining it might be a roadblock to beginners and innocent entrepreneurs. Any entrepreneur can select their digital device and simply visit Legamart Directory, where highly experienced legal professionals are waiting to answer all their questions.

Why is an LC Significant?

An LC is advantageous for both parties as it ensures and assures the vendor that he will acquire his funds upon completion of the terms of the trade arrangement. Also, the consumer can illustrate his creditworthiness and bargain for more prolonged payment terms by retaining a bank after the trade dealing.

What are the features/characteristics of LC?

A specific set of regulations governs the use of LCs. These principles stay identical for various types of letters of credit. The main features of letters of credit are:

Negotiability

This is a transactional pact under which the terms and conditions can be altered/revised at the parties consent. To be negotiable, an LC shall incorporate a guarantee of payment upon request or at a specific point in time.

Revocability

A letter of credit has the flexibility of being either voidable or irreversible. A voidable LC is established on a case-to-case basis, depending upon the circumstances surrounding the issuance of the LC. In an irrevocable LC, all the players hold authority, and it cannot be altered/revised without the approved permission of all the individuals.

Transfer and Assignment

LCs can be transferred, and the beneficiary can transfer/allocate the LC. This will remain effective no matter how often the beneficiary assigns/transfers the LC.

Sight & Time Drafts

The beneficiary will only acquire the payment upon maturity of the LC from the issuing bank when he delivers all the drafts & the essential documents.

Process For Getting an LC

The procedure for getting an LC can mainly be divided into the following four steps:

Issuance of LC: Once the parties have agreed to the usage of an LC, the importer applies to the issuing bank to issue an LC in favour of the exporter. Thereafter, the LC is sent from the issuing bank to the advising bank, which is generally based in the exporter’s country and might even be the exporter’s bank. Once the advising bank has verified the authenticity of the LC, it is forwarded to the exporter.

Shipping of goods: Once the exporter receives the LC, they can verify the authenticity of the LC to their satisfaction and, after that, initiate the goods shipping procedure.

Provide documents to the confirming bank: Once the goods have been shipped, the exporter (either through freight forwarders or on their own) submits the necessary documents to the advising bank.

Settlement of payment from importer and possession of goods: The documents submitted to the advising bank are sent to the issuing bank, and the amount is paid and accepted (or negotiated). Once the issuing bank verifies the documentation and obtains the payment from the importer, it sends the documentation to the importer. The importer then uses the documentation to receive the possession of the shipped goods.

What are the documents required for an LC?

- Shipping Bill of Lading. This is a receipt issued by a carrier of goods transported to the destination. This details the terms and conditions of the entire transit.

- Air wayBill. This is a receipt issued by an air carrier, which indicates the receipt of the goods transported.

- Commercial Invoice. It is an itemized account issued by the beneficiary and addressed to the applicant. The specifications of the commercial invoice must be in accordance with the letter of credit.

- Insurance Certificate. Under certain jurisdictions, the beneficiary is obliged to arrange insurance and to further furnish with an insurance certificate. The coverage and risks associated with the insurance must be mutually agreed upon by the seller and the buyer at the initial negotiation stage of the contract itself.

- Certificate of Origin. This certificate is used to certify the country of origin of the described goods. It must comply with any stipulations of the LC of the originating country, along with the specifications of the issuing bank.

- Packing List. This list is often requested by the buyer, to help them identify the contents of each package and container. It is expected to show the shipping marks and the number of each package.

- Certificate of Inspection. This certificate provides details about by whom the certificate is issued. It is used as a preventative measure against fraud and to protect the buyer from unwanted or substandard goods. It is issued by a reputable neutral third party and indicates that the goods have been adequately examined and are according to what had been ordered.

If any documents are not in accordance with the letter of credit, the document can get dishonoured. In such a case, the party is provided with an adequate opportunity to correct the documents or to negotiate the draft with the issuing bank.

What are the fees payable for an LC?

Miscellaneous expenses and refunds are implicated when it comes to letters of credit. Generally, the expenditure under LC is governed by all players. The expenditures charged by banks may include the following:

Opening charges, including the commitment expenditures, are charged upfront, and the issuance fees are levied for the approved tenancy of the LC. But keep in mind that removal expenses are owed at the end of the LC duration.

In addition, these expenses include:

- Consultatory expenditure imposed by the advising bank,

- Reimbursements owed by the applicant to the bank in endorsement of alien law-related responsibilities,

- Validating bank’s fee, and

- Bank expenses payable to the issuing bank.

The standard cost of a letter of credit is around 0.75% of the total purchase cost. For LCs with a higher value, say in 6 figures (around $250,000), the fee can add up further and benefit the bank since banks profit from the interest you pay on loan. It is possible for the costs to reach about 1.5% of the total purchase cost in such situations.

While the buyer picks up the cost for the LC, there may be situations where the seller is also expected to pay some charges.

Some examples of such a situation can be related to wire transfer costs, courier fees, and bank fees. Therefore, a seller can also pay an LC fee ranging from $25-$150.

In addition to these costs, the buyer might also be expected to put down a deposit on the LC to prove that the buyer is serious about repaying the money to the bank. This deposit is usually around 1% of the total purchase cost.

What are the types of letters of credit?

Below is a list of the various types of letters of credit:

Irrevocable LC: This letter of credit cannot be cancelled or revised without the proper authorization of the beneficiary (Vendor). Irrevocable letter of credit reminisces the complete and unconditional liability of the issuing bank to the other player.

Revocable LC: This unique kind of letter of credit can be rescinded or revised by the bank (issuer) at the consumer’s mandate without the previous arrangement of the beneficiary (Seller). The bank will not have to pay any penalties to the beneficiary after revoking the letter of credit. However, there are various cases where you should learn about where a bank can revoke a revocable letter of credit and when a revocable LC can become irrevocable.

Stand-by LC: This letter of credit is closer to the bank guarantee and gives the Seller and Buyer a more flexible collaboration opportunity. The bank will honour the letter of credit when the buyer fails to fulfil payment liabilities to the seller.

Confirmed LC: In addition to the bank’s promise of the issue of a letter of credit, this kind is confirmed by the vendor’s bank or any other bank. Irrespective of the expenditure by the bank administering the letter of credit (issuer), the bank that corroborates the LC is liable for the implementation and execution of commitments.

Unconfirmed LC: Only the bank issuing the LC will be liable to pay this letter of credit since it shall remain unconfirmed by any other bank, including the vendor’s bank.

Transferable LC: This enables the seller to assign part of the LC to the other party. This is especially beneficial when the seller is not the exclusive producer of the goods and buys some components from other players, as it eradicates the need to extend numerous letters of credit to other players.

Back-to-Back LC: This considers issuing the second LC based on the first LC. It is opened in favour of the intermediary per the buyer’s instructions. Based on this LC and the instructions of the intermediary, an LC is opened in favour of the seller of the goods.

Payment at sight LC: In this type of LC, the settlement of funds is fulfilled to the vendor with immediate effect (maximum within 7 days) after the necessary records have been surrendered.

Deferred payment LC: In deferred payment LC, the payment to the seller occurs not when the documents are submitted but at a later date. In most cases, the payment in favour of the seller occurs upon receipt of goods by the buyer.

Red clause LC: The seller can request an advance for an agreed amount of the letter of credit before the shipment of goods and submittal of required documents. The idea behind naming it the red clause is that it is commonly printed in red on the document to attract engagement to the “advance payment” clause of the credit.

Green clause LC: Green Clause LC is often considered an extension of the Red Clause LC. While it is possible to cover the costs for purchasing raw materials, packaging and processing of goods, etc., through a Red Clause LC, Green Clause LC takes a step further to include the pre-shipment warehousing at the port of origin and the insurance. Therefore, these types of LC require greater documentation, and you are expected to submit the title documents to the bank as proof of the warehouse status.

Freely Negotiable LC: This type allows any bank to become nominated if it is willing to pay, accept, and incur the deferred payment undertaking or negotiate the LC. It must be specifically mentioned in the LC that it is not restricted to any bank for negotiation or that it is possible to be negotiated by any bank.

Revolving LC: This is when the amount mentioned gets reinstated after payment, reducing the need to create a new LC. It is most commonly used when shipping diverse goods or repeating the same goods within a specific period.

Green Clause LC are most common in rice, ore, gold, and grains markets. Similar to Red Clause LC, the name Green Clause LC is generated due to the traditional practice of printing special clauses in green ink.

What are the advantages and disadvantages of an LC?

Advantages

- LC provides an opportunity to transact with unknown partners or quickly help further newly established businesses.

- LC is safer for the exporter or seller if the importer or buyer goes bankrupt. This is because the creditworthiness of the importer is transferred to the bank that issued the LC.

- LC provides both trading partners with an opportunity to form a mutual list of clauses and provides the parties with an opportunity of strengthening their contractual relationship.

- In case any dispute arises between the parties, the LC provides the exporter the opportunity to first withdraw the funds through the LC, and, thereafter, resolve the dispute with the importer.

Disadvantages

- LC adds to the cost of doing business with the bank since the bank charges a specific fee for providing the LC services. It is up to the discretion of the bank to increase the fee in case parties wish to include additional features in their contract.

- LC is capable of imposing a fraud risk on the bank. Usually, the bank pays the exporter after looking through the shipping documents and not by looking through the quality of the goods. Therefore, it still becomes possible for disputes to arise in the future.

- The life cycle of an LC has an expiry date; hence, the exporter is bound by a time limit to execute the LC. This often leads to further confusion between the parties.

- The time-bound manner of the LC is a major disadvantage since the export is time restricted to deliver the goods. The haste is capable of causing further complications between the parties.

Bank Guarantee v. Letter of Credit

Bank Guarantee is a commercial instrument, an assurance the bank gives for a non-performing activity. Therefore, if any activity fails, the bank takes the responsibility of paying the dues. There are 3 parties involved in the process – Applicant, Beneficiary, and Banker.

Letter of Credit is a commitment document, an assurance the bank or any other financial institution gives for a performing activity. This means that the importer guarantees the payment, subject to the conditions mentioned in the LC. There are four parties involved – Exporter, Importer, Issuing Bank, and Advising Bank.

Conclusion

To individuals who wonder how an LC works, often in international trade, an LC is used to signify that payment will be made to the seller on a specific duration and in full, as insured by a bank or economic organization. After dispatching an LC, the bank will levy a cost, generally a percentage of the LC, in addition to mandating collateral from the consumer.

Letters of credit play an essential function in trade dealings. Different letters of credit may be used, depending on the circumstances. However, to avoid such intricacies and determine the correct type, you can reach a global network of highly skilled international lawyers on Legamart who will assist you in the process.

Frequently Asked Questions (FAQs)

What is a letter of credit?

An LC is a written document issued by the importer’s bank (the opening bank) on the importer’s behalf. Through its issuance, the vendor is assured that the issuing bank takes the full guarantee to compensate the exporter for the multinational trade executed between both groups.

When is a letter of credit required?

It is mainly required in long-distance or international transactions or for recently started trading businesses. The Letter of Credit helps reduce the risk of non-payment of the goods.

Is there a fee for a letter of credit?

The bank does charge a fee for issuing a letter of credit. The fee depends on several factors, such as the risk amount and the type of letter of credit involved.

What type of collateral is required by the bank in exchange for the Letter of Credit?

This depends on the strength of the applicant’s finances, along with a set of bank-specific criteria. The bank makes a final decision to provide the letter of credit once all their conditions are met.