For the traders doing business in the GCC region who need access to Europe and Africa, Oman recently has been an indisputable choice to go for. Access to Bab al-Mandab Strait, political stability, and steadily growing economy along with a high rank of GDP in the region, has made Oman a distinctive location in comparison with Dubai or Saudi Arabia to run your business. Oman’s three main free zones are governed under business-friendly rules which allow 100% ownership and tax-free policies on profits and dividends for 30 years. Oman’s government’s support of foreign investment and trade and the positive overview of its ever-growing economy make it a forward-looking investment opportunity.

The primary legislation governing companies in Oman is Commercial Companies Law. This law was enacted by Royal Decree Number 18 of 2019 and repeals in full the previous law on this subject.

Article 4 of the Commercial Companies Law enacted by Royal Decree Number 18 of 2019 (“Companies Law”) states that Commercial companies shall take any of the following forms

- General Partnership;

- Limited Partnership;

- Joint Venture (JV) ;

- Public/ Closed Joint Stock Company;

- Holding Company;

- Limited Liability Company (LLC); or

- Sole Proprietorship.

To access the African continent, you should register your business in Oman.

You can also contact our lawyers in Oman.

Strategic Location

Oman’s geographic location is very much important in promoting business possibilities in the country. Geographically Sultanate of Oman locates at a strategic location, which is most favorable for business development. It has a travel time of fewer than two hours to major commercial hubs of Asia, Africa, and Europe. Based on this advantage Oman is planning to develop as a global logistics hub. The sultan’s long-term development strategy, Oman Vision 2020, emphasizes industrialization, privatization, and Omanisation. Logistics, tourism, and industrial manufacturing have been identified as potential future economic drivers.

Strong Economy

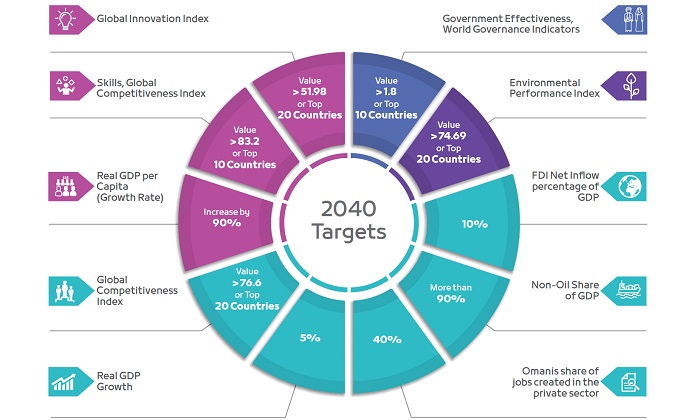

Oman is a country with a relatively stronger economy in the region. From the 1998 Oil price crisis, Oman started diversifying its economic base to different sectors. Vision 2020 is really targeting to decrease oil sector share to less than 10 percent of GDP. Vision 2040, at the same time, plans to attract large-scale foreign investment in the fields of tourism, infrastructure, technology, and manufacturing.

Oman Business Forum (OBF)

An initiative to collaborate with public and private sectors to unlock business ideas and growth opportunities in Oman. The prominent objectives of the firm are knowledge sharing, business opportunities, collaborative partnership, and value-added networking.

Favorable Tax and Investment Laws

Oman offers favorable tax and investment laws which makes the ease of doing business better. In Oman, there is no personal income tax for business owners or employees. There are no foreign exchange restrictions or levies, and there is an exemption from corporate income tax on the first OMR30,000. Once established, a company typically has a flat rate of 15% corporate tax. Within free zones, there is a complete exemption from corporate taxes for up to 50 years.

International Appeal

Oman is part of various trade agreements which allow free trade and liberalized laws, including trade agreements of GCC, GAFTA, FTAs with the US and Singapore, Iceland, Norway, Switzerland.

Political Stability

Oman is the Arab country with the highest political stability. It is the first country that got independence in the region. The business environment in Oman is absolutely safe. No kind of political or social issue hinders the act of business. Moreover, only a flat rate of 15% of corporate tax is charged.

Infrastructure

Oman has a world-class infrastructure that can compete with any of the countries in GCC and outside. Highly developed ports, airports, and large road networks make Oman a business-friendly nation.

Vision 2040

Oman’s government is continuously making efforts for business development in the country. The government has started a single-window system through which companies can start working smoothly. Moreover, the Government offers incentives like tax exemptions, interest-free loans, free trade zones, and preference in the allocation of government land. As per vision 2040, the focus of Oman’s economy will change from Oil to many other fields like tourism, technology, hotel, real estate, infrastructure, and production. For this, Government has a favorable policy for any kind of business initiative. Hence this is the most important factor that attracts business to the country.

The Services We Can Provide

| Type Of Company to be incorporated | Professional Fees in Euro (“EUR”) |

| General Partnership | 2.295 |

| Limited Partnership | 2.295 |

| Joint Venture | 2.295 |

| Limited Liability Company | 2.295 |

| Sole Proprietorship | 2.295 |

| Holding Company which is a Limited Liability Company | 2.295 |

| Joint Stock Company either Public/ or closed | Case to Case Basis |

You can submit your request here.