Yin Dark Side

Money Depreciation, Lack of Safety & Soaring Inflation

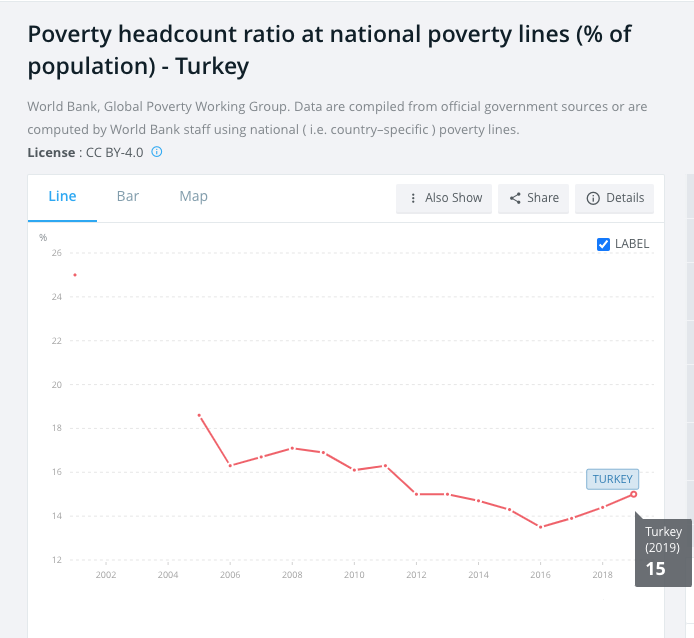

While Turkey has many bright sides to ponder, it is also notorious for its negative statistics. The country stands 149th in the Global Peace Index 2021 ranking out of 163 countries. According to the latest data provided by The World Bank, Turkey suffered 15% below the poverty line.

To study more about the pros of Turkey, you can read the article below:

A True Yin-Yang basis Country: Turkey (I)

A simulation analysis of the pandemic impacts suggests that “Turkey had 1.6 million more poor people in 2021 than 2020, reaching the highest poverty rate since 2012,” according to World Bank Data.

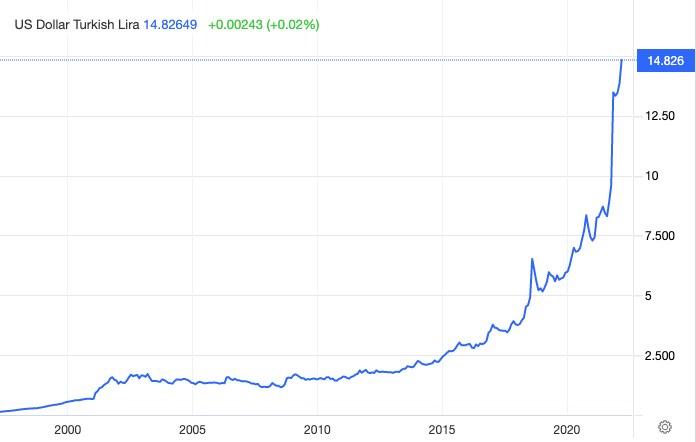

This data will be completed by Inflation increase continuation, weakening of the lira, rising international commodity prices, and demand-side pressures. Consumer price inflation reached 19.3 percent, and food prices soared by 29 percent, while producer price inflation rose by 45.5 percent.

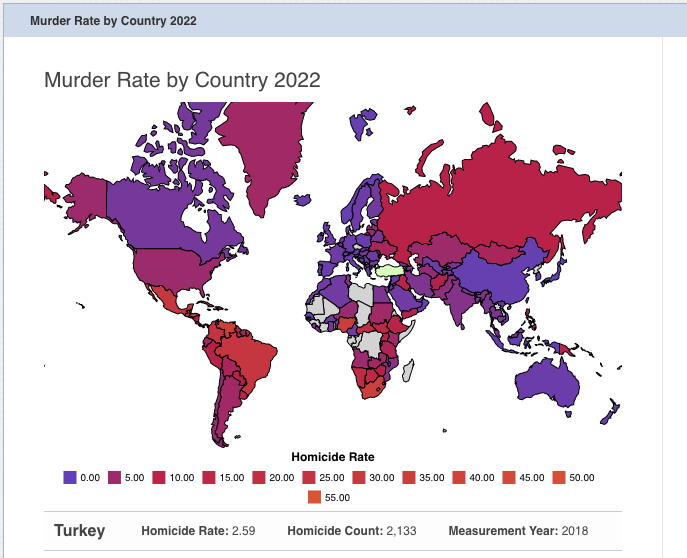

The above-mentioned data could add up to the crime increase since the 1990s, reported an increase of 400% in 2014 by the Turkish Ministry of Justice. Though Turkey handled 3.6 million Syrian refugees in the best way possible, the issue caused a lack of safety in Turkey.

With 89.5% of the population being Muslim, Turkish people are famous for honor killings & are among the countries with its Human Rights stance under question for a lack of freedom of speech, torture & deaths in custody among ethnic minorities. It is to reiterate that, based on the data gathered in 2018, the homicide rate in the country is 2.59, with a homicide count of 2,133.

A secular country, Turkey’s economic growth coincided with the Islamization of the country, which led to the deepening gender gaps in the past decade, increasing the risk of inequalities in the country. The COVID-19 crisis impacted and increased the youth unemployment rate to 11.4%, aside from the negative consequences having led to weakening economic and social gains.

Forbes 2000 list for Turkey; Banks are the leaders

It is unusual to see the presence of 5 Turkish Banks among nine companies on the list of Forbes 2000 back in 2021. This lies in the establishment of The Banking Regulatory and Supervisory Agency (BRSA) in 2000.

Before that, the Turkish economy was hit by significant blows with currency devaluation by 56%2 over one year and customer deposit rates at 7000%. The emergence of BRSA was key to a clean-up of the sector, which lasted until 2003. According to a report gathered by Marsh & McLennan, after 2003 “the Turkish banking sector was rebuilt under the close supervision of the BRSA and reoriented to provide more financing to the real sector and individuals.

The penetration of loans to GDP doubled from 15% in 2003 to 29% in 2006. By 2006, the Turkish banking sector had become an attractive investment opportunity, with annual growth rates and Return on Equity (ROE) both at more than 20%.”

It should not be forgotten that Bank Managers are among high-earning jobs with Accounting and Business administration degrees ranked 4th in the top 10 list. Their salary range is from $633 up to $1,963.

| Rank | Name | Country | Sales | Profit | Assets | Market Value |

| 589 | Koç Holding | Turkey | $20.5 B | $1.3 B | $84.8 B | $5.7 B |

| 673 | Isbank | Turkey | $13.7 B | $1 B | $94 B | $2.7 B |

| 804 | VakifBank | Turkey | $7.9 B | $1.1 B | $80.4 B | $1.7 B |

| 871 | Garanti Bank | Turkey | $7.2 B | $947 M | $72.9 B | $3.8 B |

| 891 | Sabanci Holding | Turkey | $7.7 B | $524.2 M | $93.7 B | $1.4 B |

| 971 | Halkbank | Turkey | $1.9 B | $781.1 M | $3.8 B | $44.6 B |

| 1006 | Akbank | Turkey | $5.7 B | $870.3 M | $64.4 B | $3.2 B |

| 1766 | Ford Otosan | Turkey | $7 B | $596.8 M | $3.3 B | $8.1 B |

| 1938 | Turkish Airlines | Turkey | $6.6 B | $-795.1 M | $25.2 B | $2 B |

Turkey experienced four golden years (2006-2009) as “the ROE for the sector has fallen below the hurdle rate that investors would be expecting from the sector,” according to the report.

Thus, the profitability decreased due to numerous powerful players. In line with other maturing sectors, the sharp decline in Turkey’s Banking sector with “market interest rates have gone down from 25% in 2004 to 11% in 2015. It is worth mentioning that Turkey has the highest level of competition in the banking sector among key European countries according to the image below:

Lawyers in need of Taxation & Bureaucratic Regulations

Though starting a business in Turkey takes less than a week (six days), it involves numerous procedures making it strict about navigating for overseas firms. These difficulties include companies depositing a percentage of capital to the account of the Competition Authority aside from depositing initial money into a bank.

Post notarising the articles of association, filing the incorporation notice form, having legal books officially certified alongside following up on the Commercial Registry’s notification.

Dealing with Construction Permits

According to The World Bank and International Finance Corporation (IFC), Turkey is a challenging country dealing with construction permits (142nd). Twenty procedures should be completed during 180 days, which is higher than the OECD norm of 143 days.

Getting Electricity

Getting an electrical connection requires work from engineers, permitted by BEDAŞ, local municipality, and Chamber of Electrical Engineers (EMO), taking at least 70 days!

Getting Credit and Protecting Investors

Turkey is still underdeveloped from a finance and legal perspective, which is why alongside Lawyers, Finance Officers (ranked 6th of highly-paid professions whose salary range is from $555 to $1,718) have an essential role in uplifting the obstacles of businesses.

Getting credit and protecting investors is a gruesome task due to the poor legal rights index and credit information index compared to other countries in Eastern Europe and Central Asia.

Paying Taxes

Corporate entities in Turkey face a tiring 223 hours of their working year on taking care of taxation. Levies such as Transaction tax on checks, stamp duty on contracts, and advertising tax are confusing for multinational enterprises working in Turkey.

Trading Across Borders

For importing and exporting goods, two weeks for logistics alongside seven documentation are to be kept in place.

Enforcing Contracts

Most contract enforcements happen through trial and judgment procedures taking 420 days to execute.

Resolving Insolvency

As previously mentioned, The World Bank and IFC rank Turkey in 124th place globally for ease of resolving insolvency mainly due to the process taking an average of 3.3 years.

Culture

There is a culture clash of east & west even in the field of work. Financial Reporting is not based on global criteria yet, making economic development & investment opportunities proceed at a slower pace & skilled staff challenging to adapt.

Complicated Bureaucracy

Other entrepreneurs complain about excessive bureaucracy, which means it can take six months to establish a new company and a complex tax system, including a new digital services tax that could hit Trendyol just as hard as Amazon.

Yin-Yang Balance

Turkey; Silicon Valley of the Orient

Although the Turkish economy has struggled to maintain its rapid expansion started back in 2002, the growth momentum continued by 8.5% in 2021 & continued its path with a hiccup of 3 percent and 4 percent in 2022 and 2023.

Though Corona-hit, in 2021, the hottest new ideas in online retail did not get their commencement in Silicon Valley but in Istanbul.Getir, founded in 2015, is a Decacorn start-up sponsoring Tottenham Hotspurs, Galatasaray, Fenerbahçe & Beşiktaş football clubs.

The mobile app offers on-demand “ultrafast” delivery, takeaway food delivery, online grocery shopping, online water ordering & ordering from local businesses is worth $11.8 billion. According to getting co-founder, Nazım Salur, who also founded Turkish ride-hailing app BiTaksi, no venture capitalists would return calls from a Turkish start-up in the first three years.

Geter’s success started back in 2020 and is part of a vast paradigm shift in Turkey’s business models, exclusively in the tech industry. Since the summer of 2020, Turkish tech companies, including eCommerce platforms “Trendyol”( e-commerce online platform valued at $16.5 billion, becoming the first Turkish Decacorn, majority-owned by Alibaba) and “Hepsiburada”( another online shopping platform valued at $4.2 billion) emerged & fostered in the global market with an incredible pace.

The scene of gaming has not been far from this very emergence with game developers such as Peak Games( a mobile gaming company based in Istanbul, acquired by Zynga in June 2020 for $1.8 billion), and Dream Games(Istanbul-based mobile game developer, maker of the puzzle app “Royal Match” worth $2.75 billion) have established global presence as Turkish start-up successes.

In 2023, Turkey’s net migration rate is -3.731 per 1000 population, which is a 63.14% increase from the previous year’s -2.287. The 2022 figure itself marked a substantial 170.97% rise from the rate recorded in 2021.

Considering the reported rise in immigration from Turkey, individuals contemplating a move may find Norway an appealing destination. With a reputation for cost-effectiveness, robust health indicators, impressive life expectancy, and rich cultural exposure, Norway presents a compelling opportunity for those seeking international relocation.