Introduction

The widespread use of sanction compliance as a policy instrument, a complex and increasingly vital area within Legal Practice & Specialization, shows no signs of abating. Sanctions are crucial to many foreign affairs concerns in the United States, the European Union, the United Kingdom, and many others. Moreover, pressure from both short-term and long-term geopolitical upheavals assures that administrations will keep depending on penalties as a crucial weapon for exerting economic influence and advancing policy objectives.

The challenges organisations face regarding sanctions compliance and risk are diverse and numerous, ranging from the operational challenge of screening huge quantities of third-party companies to the investigatory issue of recognising people or organisations who are still sanctioned or may be sanctioned in the years ahead.

To strengthen their capacity to foresee and analyse sanctions risk, risk management and compliance departments are increasingly going to appeal to adjacent departments, such as public policies and government relations teams, as well as, in some instances, expert members of ESG teams. Penalties are a politically driven weapon for foreign affairs. To evaluate and lessen its vulnerability to sanctions, an organisation must first examine global political events and then interpret those trends within regional economic and political landscape of individual nations.

What is Sanction compliance?

Sanction compliance refers to adhering to the rules and regulations imposed by a government or international body to restrict economic and political interactions with targeted individuals, organisations, and countries. These regulations aim to achieve various objectives, such as promoting national security, preventing the spread of weapons of mass destruction, and addressing human rights abuses, among others.

Top strategies for sanction compliance

Foreign sanctions harm businesses in any sector and, as current action taken has demonstrated, businesses of all sizes. As a result, penalties are among the most significant risk elements to examine in every compliance framework. With the possibility of severe financial fines and reputational risk, no one wishes to be discovered to have commercial links to a sanctioned firm. To ensure compliance with sanctions, organisations must adopt strategies that facilitate due diligence, risk management, and ongoing monitoring. Here are some of the top strategies for sanction compliance around the world:

Risk assessment

Conducting a risk assessment is the first step towards compliance with sanctions. Organisations must evaluate their business operations and assess the potential risks associated with their activities, including their customers, vendors, and partners. They can take necessary measures to mitigate the risks of violating sanctions by identifying high-risk areas. To get a risk assessment done for your organisation or firm, reach out to our Corporate Lawyers, who have years of experience with sanction risk assessments and following the extended process of risk identification, quantification and prioritisation.

Know your customer (KYC) and know your supplier (KYS)

KYC and KYS are essential compliance strategies that involve verifying the identity of customers and suppliers and assessing their suitability for business transactions. In addition, organisations must ensure that they are not doing business with individuals or entities that are sanctioned or restricted.

Screening

Screening is a critical component of sanction compliance, which involves screening customers, suppliers, and transactions against various sanction lists. These lists are maintained by government agencies, international bodies, and other regulatory authorities. Screening helps organisations identify sanctioned individuals and entities and prevent them from engaging in prohibited transactions.

Enhanced due diligence (EDD)

EDD is an advanced form of due diligence that involves conducting a more detailed investigation of high-risk customers or transactions. EDD may include additional background checks, site visits, or third-party audits to assess the level of risk associated with a particular business relationship.

Training and awareness

Organisations must provide regular training and awareness programs to their employees to ensure they understand the importance of sanction compliance and their role in implementing it. This includes training on identifying suspicious transactions and reporting them to the relevant authorities.

Monitoring

Ongoing monitoring of transactions and business relationships is essential to sanction compliance. Organisations must implement effective monitoring systems to identify and prevent real-time prohibited transactions. This includes monitoring transaction patterns, customer behaviour, and other potential risk indicators.

Conducting third-party due diligence

Organisations must also conduct due diligence on third-party service providers, such as agents, distributors, and intermediaries. These third parties may engage in activities that can lead to sanctions violations, and organisations must ensure that they are not unknowingly facilitating such activities.

Implementing internal controls

Internal controls are policies and procedures designed to prevent, detect, and correct sanctions violations. Organisations must implement robust internal controls, such as segregation of duties, access controls, and data privacy measures, to mitigate the risk of sanctions violations.

Regular auditing and monitoring

Regular auditing and monitoring of compliance programs are critical to ensure that they remain effective and up-to-date. Organisations must conduct regular audits to identify gaps in their compliance programs and take corrective actions to address them.

Ensuring document retention and recordkeeping

Document retention and recordkeeping are essential components of sanction compliance. Organisations must maintain accurate and complete records of all transactions and communications, including emails, contracts, and financial statements, to demonstrate their compliance with sanctions.

Engaging external consultants

Organisations may engage external consultants, such as legal advisors and compliance experts, to provide guidance and support in developing and implementing their sanction compliance programs. These consultants can provide specialised knowledge and expertise to help organisations navigate complex sanction regulations.

Establishing a sanctions compliance officer

Organisations must appoint a sanctions compliance officer (SCO) responsible for overseeing the implementation of the compliance program. The SCO should have the authority and resources to enforce the program, report any violations, and ensure that the organisation complies with all applicable sanctions regulations.

Implementing a whistleblower policy

Organisations must encourage and protect whistleblowers who report sanctions violations. A whistleblower policy should provide employees with a safe and confidential channel to report suspicious activities and protect them from retaliation.

Establishing a compliance culture

A culture of compliance is critical to ensuring that all employees understand the importance of sanctions compliance and are committed to preventing violations. Organisations must establish a compliance culture by promoting ethical behaviour, encouraging transparency, and providing incentives for compliance.

Engaging with industry associations

Engaging with industry associations is a powerful strategy for sanction compliance. Industry associations are professional organisations that represent the interests of businesses operating within a particular industry. They provide a platform for networking, education, and advocacy and can be a valuable resource for businesses seeking to stay up-to-date on sanctions regulations and compliance requirements. These associations can provide insights into industry-specific risks, best practices, etc.

Developing a crisis management plan

Organisations must develop a crisis management plan that outlines how to respond during a sanctions violation. The plan should define the roles and responsibilities of key stakeholders, provide guidelines on communication, and outline the steps that must be taken to mitigate the impact of the violation.

Conducting due diligence on mergers and acquisitions

Due diligence must be conducted on mergers and acquisitions to ensure that the target company is not subject to sanctions or involved in activities that can lead to sanctions violations. Organisations must also ensure they do not inadvertently acquire sanctions risks as part of the transaction.

Conducting regular risk assessments

Risk assessments must be conducted regularly to identify changes in the organisation’s risk profile and ensure the compliance program remains effective. The assessments must be updated to reflect new sanctions or regulatory requirements, and organisations must develop appropriate risk mitigation strategies.

Implementing technology solutions

Technology plays a crucial role in enabling organisations to comply with sanctions regulations. Organisations can implement various technology solutions, such as sanctions screening software, that automate compliance processes and enhance the effectiveness of compliance programs.

Finally, effective sanction compliance strategies involve the following:

- Conducting a thorough risk assessment.

- Implementing robust due diligence processes.

- Screening for sanctioned individuals and entities.

- Providing regular training and awareness to employees.

- Implementing effective monitoring systems.

By adopting these strategies, organisations can prevent sanctions violations, protect their reputation, and avoid legal and financial penalties.

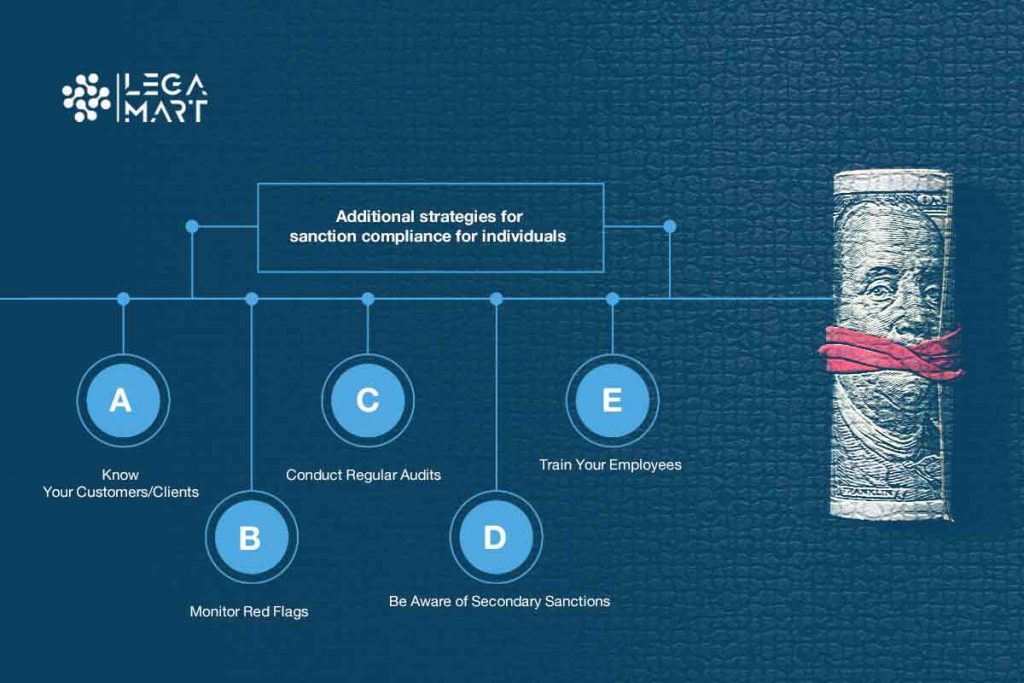

Additional strategies for sanction compliance for individuals

Here are some additional strategies for individuals on sanctions compliance:

Know your customers/clients

For businesses, knowing your customers/clients and conducting appropriate due diligence is essential to ensure that they are not subject to sanctions or engaging in prohibited activities.

Monitor red flags

Monitor for red flags indicating potential sanctions violations, such as unusual payment patterns, shipping routes, or parties involved in a transaction. Any such red flags should be thoroughly investigated.

Conduct regular audits

Conduct regular audits of your transactions, policies, and procedures to identify any gaps or areas for improvement. Audits can also help identify potential violations and ensure your compliance program is effective.

Obtain licences

Obtain licences for transactions subject to sanctions, such as transactions involving countries or individuals under sanctions.

Be aware of secondary sanctions

Be aware of secondary sanctions, which can apply to non-US persons or entities that engage in transactions with sanctioned countries or individuals. This means that even if you are not a US person or entity, you may still be subject to sanctions for certain transactions.

Review contracts and agreements

Review contracts and agreements to ensure that they include appropriate sanctions compliance clauses and require compliance with applicable laws and regulations.

Use technology

Use technology to assist with sanctions compliance, such as sanctions screening software or transaction monitoring systems. These tools can help identify potential sanctions violations and streamline compliance processes.

Train your employees

Train your employees on sanctions, regulations, policies, and procedures to understand their responsibilities and the potential consequences of noncompliance. Regular training can help ensure that compliance remains a top priority.

By implementing these additional strategies, individuals can further reduce the risk of sanctions violations and demonstrate a commitment to compliance. It is vital to remain vigilant and up-to-date on changes to sanctions regulations to ensure ongoing compliance.

How are the strategies for individuals and organisations different?

Regarding sanctions compliance, the strategies and approaches for individuals and organisations are different because they face different risks and responsibilities. For individuals, the risk of sanctions violations may be lower, but the consequences can still be severe. For example, violating sanctions can result in fines, criminal charges, and even imprisonment. As a result, individuals need to be aware of the sanctions regimes that apply to them and avoid engaging in any activities that may be prohibited.

For organisations, the risks of sanctions violations can be more significant, given the scale and complexity of their operations. Companies may have thousands of employees, businesses in multiple countries, and complex supply chains. As a result, they may face greater scrutiny and are more likely to be subject to actions of enforcement agencies if they violate sanctions. Moreover, the consequences of sanctions violations can be severe, including significant fines, reputational damage, and the loss of business opportunities.

Overall, the strategies and approaches for sanctions compliance differ for individuals and organisations because they face different risks and responsibilities. Individuals need to be aware of the sanctions regimes that apply to them and avoid engaging in prohibited activities.

Organisations, on the other hand, need to develop comprehensive compliance programs that cover all aspects of their operations to avoid the significant risks and consequences of sanctions violations.

Consolidated Compliance Programs

Sanction compliance cannot be done in isolation, considering it is a component of a business’s financial crime compliance. Therefore, sanctions due diligence must closely align with anti-money laundering (AML) and anti-bribery compliance, the consolidation of which can help businesses mitigate their financial risks more effectively. The combination of AML due diligence, anti-bribery due diligence, screening for politically exposed persons, and adverse media checks help provide a holistic view of the risks in place.

This is further capable of providing a commercial advantage to the organization since they can articulate their risks better. After all, considering the complex geopolitical environment, successful businesses know when to offer their products and services to clients and when not to offer their products and services.

How to determine relevant sanctioning bodies for your business?

Be up-to-date with the active sanctioning bodies in your jurisdiction, as well as in territories in which the country has partnerships and alliance trades, along with the currencies being operated in. Some of the common sanction lists that may be referred to are:

- HM Treasury Sanctions List. This list applies to all individuals and legal entities within the jurisdiction of the UK, who undertake activities within the UK, or those established under UK law. The Office for Financial Sanctions Implementation (OFSI) enforced and monitored the list.

- EU Consolidated List of Sanctions. This list applies to all EU citizens or corporate entities either constituted as a member state or overseen by the EU Council.

- OFAC Sanctions List. This list applies to all the US citizens and entities constituted in the US. It also applies to entities that trade in US dollars, US goods, US components or through a US parent or affiliate. The list is overseen by the US Office of Foreign Assets Control (OFAC).

- UN Sanctions List. This list applies to all UN nation-states and is enforced and overseen by the UN Council.

How to create an effective sanctioning process?

You require a proactive approach to keep track of the sanctions, watchlists, and politically exposed persons (PEPs). The following practices can help you in the implementation of an effective sanction check:

- Have a top-down approach through a culture of compliance from the Board to the managers and employees.

- Ensure that the policies and procedures involving the sanctions environment are up-to-date by keeping track of the UN Security Council sanctions and those involving the United States and other countries.

- Ensure that you have communicated the procedures and policies to your employees and any third person that might be operating on behalf of your organization.

- Actively train employees and third-party agents with their sanction compliance obligations and provide them training about how to recognize and address sanction-related compliance.

- Have a risk-based sanction screening process with a tailored approach to the specific size, nature, and risks attached to your business.

- Sanction screening should be aligned with the due diligence procedure, along with the monitoring of ongoing risks.

- Procedures must be made inclusive of escalation contacts for both sanction enquiries and violation reporting.

- Regularly review and audit the sanction screening policies, and don’t wait for enforcement action to put these best practices into practice.

General challenges during the sanctions screening process

While it is effective to have a sanction screening process, the process comes with unique challenges and limitations. Some of them are listed below:

- Evasive behaviour of PEPs or persons related to PEPs. There is a high possibility that individuals under scrutiny might avoid detection through shell companies in offshore jurisdictions under fake names. Therefore, proper due diligence must be conducted in all cases.

- Screening might require more than one sanctions list, capable of posing consolidation and data corruption risks.

- Inadequate internal data management might result in problems. This includes situations where you fail to compete, verify, or maintain the information about parties you regularly work with.

- Naming conventions and names written in Chinese, Cyrillic, or Arabic alphabets might pose a problem. However, through the use of adequate technology, the same can be overcome.

- Manual data entries pose the risk of human error, and hence, proper checks and balances must be in place to mitigate these risks.

- Isolated internal systems, such as non-integrated data between the subsidiaries or branches, might result in complications during an acquisition or merger procedure.

Laws related to sanctions compliance around the world

Sanctions are measures taken by countries or international organisations to restrict or prohibit certain types of economic activity or trade with a particular country or entity. The laws and regulations governing sanctions compliance vary depending on the country or region. Here is a brief overview of the laws related to sanctions compliance in the USA, UK, India, and Australia:

The USA (United States of America)

The primary law related to sanctions compliance in the United States is the International Emergency Economic Powers Act (IEEPA). This law authorises the President to declare a national emergency in response to any unusual or extraordinary threat to national security, foreign policy, or the economy. The President of the United States can then use this authority to impose sanctions on a foreign country, entity, or individual. Additionally, some laws and regulations pertaining to particular countries and regions, such as the Iran Sanctions Act and the North Korea Sanctions and Policy Enhancement Act.

The UK (United Kingdom)

UK sanctions are one of the most exciting concepts to know about. In the United Kingdom, the primary law related to sanctions compliance is the Sanctions and Anti-Money Laundering Act 2018. This law allows the UK government to impose sanctions on a foreign country, entity, or individual for various reasons, such as human rights abuses, economic crime, terrorist activities, or violations of international law. The law also requires UK businesses and individuals to comply with sanctions and to report any suspicious activities related to sanctions violations.

India

In India, the Foreign Exchange Management Act (FEMA) is the primary law related to sanctions compliance. This law regulates all foreign exchange transactions in India and prohibits any transactions that violate international sanctions or embargoes. The Reserve Bank of India (RBI), the apex financial institution of the country, is responsible for enforcing this economic sanction and can impose penalties on individuals or businesses that violate sanctions.

Australia

In Australia, the primary law related to sanctions compliance is the Autonomous Sanctions Act 2011. This law allows the Australian government to impose sanctions programs on a foreign country to take it under sanctioned jurisdictions, also on entities or individuals for various reasons, such as human rights abuses, terrorist activities, or violations of international law. The law also requires Australian businesses and individuals to comply with sanctions and to report any suspicious activities related to sanctions violations.

Overall, sanctions compliance laws ensure that businesses and individuals do not engage in prohibited activities that could harm national security or violate international law. It is important for businesses and individuals to understand and comply with these laws to avoid legal and financial penalties; taking help from a qualified attorney and law firm is also needed depending on the requirements.

Conclusion

With the possibility of huge financial fines and reputational risk, no one wishes to have a commercial relationship with a sanctioned entity or firm.

Organisations must keep up with the demands of a fast-paced compliance environment while keeping up with regulatory change, maintain a strong compliance framework, make that framework genuinely operational, and continue enhancing processes. Synchronise a company’s objectives with the compliance team’s objectives to maintain compliance in multiple jurisdictions. Concerning sanctioned and sanctioned-by-extension entities, control risk and encourage accountability.

It takes time and effort to understand your supply chain and be able to recognise organisations that have been sanctioned or sanctioned by extension. However, access to a vast data pool is essential for boosting productivity and effectiveness without interrupting regular operations. The United Nations, European Commission, and financial institutions providing financial services globally also deal with different kinds of sanctions regimes, OFAC sanctions.

To conclude, sanction compliance is a complex and dynamic process that requires organisations to adopt a comprehensive and integrated approach. By adopting additional strategies such as conducting third-party due diligence, implementing internal controls, regular auditing and monitoring, document retention and record keeping, engaging external consultants, establishing a sanctions compliance officer, and implementing a whistleblower policy, organisations can enhance their compliance programme and mitigate the risk of sanctions violations.

Frequently Asked Questions (FAQs)

What are the 5 elements must exist in an effective sanction compliance program?

The 5 elements are:

- Management Committee

- Risk Assessment

- Internal controls

- Testing and Auditing

- Training

What are the main sanction categories to be kept in mind by businesses?

The main sanction categories are – restrictions on trade in goods and services, restrictions on engaging in commercial activities, Asset freezes, and travel bans on certain persons.

LegaMart is a global legal platform designed to connect individuals, startups, and businesses with qualified lawyers across jurisdictions. With a mission to simplify cross-border legal services, LegaMart provides users with access to a diverse network of vetted legal professionals who specialize in areas such as international law, corporate law, immigration, dispute resolution, and more.

By leveraging technology and user-friendly tools, LegaMart allows clients to search for lawyers by country, language, or legal expertise, submit their legal queries, and receive tailored legal solutions in a streamlined, efficient manner. The platform serves as a bridge between legal professionals and clients who need multilingual, multi-jurisdictional support — especially in today’s increasingly globalized legal landscape.

Whether you’re an entrepreneur launching a business abroad, an individual dealing with immigration paperwork, or a company navigating cross-border compliance, LegaMart aims to make legal help more accessible, transparent, and collaborative.