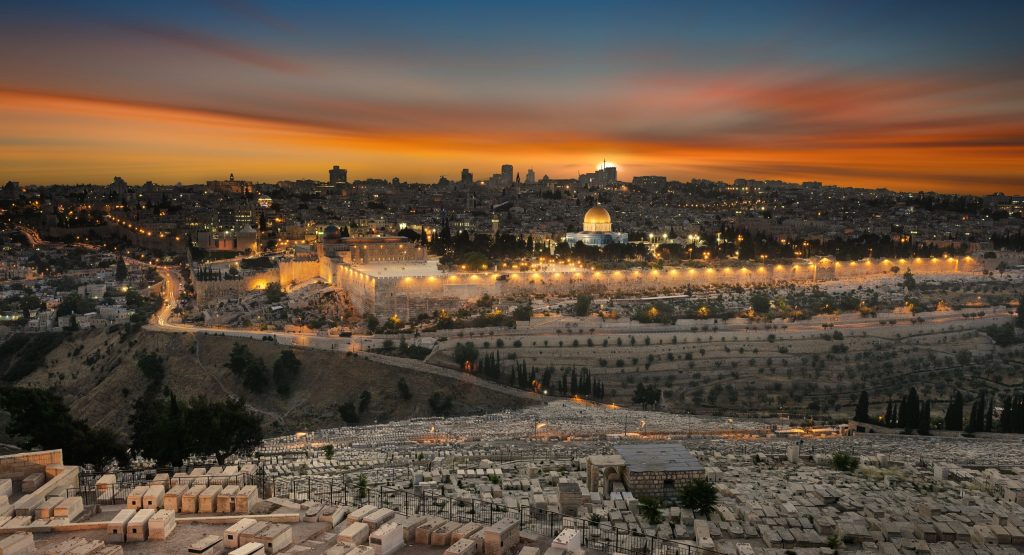

Israel

We represent clients from all around the world in Israel every year. We see the globe as having no borders and are unafraid of language hurdles or time zones.

LegaMart Lawyers in Israel

Legal Industry in Israel

Articles about Law in Israel

Tell us more about your problem.

Please give a brief description about what it is you need to talk to our lawyers about ?

Most common legal demands in Israel

Legal Market Overview in Israel

Israel is one of the fastest growing jurisdictions in Chambers Global and 2022 has been no exception to that trend. The number of ranked lawyers for Israel has exceeded 500 for the first time, with especially notable increases of our Labour & Employment and Startups & Emerging Companies legal rankings.

Israel holds over 70,000 registered attorneys, with a population of eight million. That is roughly one attorney for every 114 people – the highest number of attorneys per capita in the world, by far

Frequently Asked Questions

Is Israel a tax free country?

As a basis for income, Israeli residents are taxed on their worldwide income, while non-residents are taxed only on their Israeli sourced income. Income includes, employment, business income and passive income from bank deposits and savings.

Does Israel allow civil marriage?

Marriage in Israel is restricted to religious marriages performed by recognized confessional communities. However, civil marriages entered into abroad are recognized in Israeli law, including same-sex marriages.

How do I start a divorce in Israel?

Each party races to be the first to file their claim at the court of their choice, either in rabbinic or family court. Once a claim is filed at a particular court, all proceedings continue there. The Get, or Jewish writ of divorce, must be granted by the husband at his own volition in order to be valid.

Can anyone immigrate to Israel?

Only those of Jewish heritage and Israeli descent are allowed to immigrate to Israel freely. All other immigration circumstances are approved on a case-by-case basis

How long can foreigners stay in Israel?

Visitors are entitled to remain in Israel up to three months from the date of their arrival, in accordance with the conditions of the visa issued to them. Visitors intending to work in Israel must submit a request to the Ministry of the Interior for a special visa.

What happens if I overstay my visa in Israel?

Israeli visa laws are strict towards those who overstay their visa, and illegal residence in Israel may end up in deportation from Israel and future refusal to permit entrance to Israel. A tourist visa to Israel is usually issued for three months. This B/2 tourist visa to Israel doesn’t allow work in Israel.

Can you own property in Israel?

Although anyone can buy property in Israel, regardless of nationality or religion, foreign residents pay a higher purchase tax than Israeli residents. The purchase tax (mas rechisha) must be paid within 50 days of signing the contract

Can foreigners do business in Israel?

Yes, foreign citizens can launch a business in Israel, but there are some requirements to be met. Firstly, to establish a legal entity in Israel, foreign citizen needs to appoint a guarantor for tax purposes.

What are the most common forms of business vehicle used in Israel?

The most common forms of business vehicles are private limited liability companies.

Partnerships are typically reserved for accountants, law firms and investment funds, mutual funds and hedge funds.

When a foreign company is deciding how to operate its business in Israel, it will choose between incorporating a private limited liability company (typically a subsidiary) and registering a foreign branch. This decision is usually based on tax considerations. From a corporate perspective, if the foreign company elects to register a branch, the foreign company will be subject to Israeli jurisdiction and will be directly responsible for the debts and liabilities of the branch.

Public companies are also common in Israel, and Israeli companies can choose to float themselves on the TASE or on various other international exchanges.

Is a written contract of employment required in Israel?

The employer is not obligated to provide a written contract of employment, unless it employs a foreign worker, or it is a manpower company. However, according to the Notice to Employee and Job Candidate (Terms of Employment and Screening and Recruitment Process) Law 2002, employers must provide each employee with a notice of his/her main employment terms using a stipulated form, which includes the following details:

. Employer’s and employee’s information (name, address, ID number).

. Employment commencement date.

.Term of employment.

. Position and main duties.

. Direct supervisor.

. Salary.

. Working hours per day and per week.

. Rest day.

. Social benefits and payments.

. Details of the pension fund (and the contributions to the pension fund).

. Applicable collective bargaining agreements.

The provisions of any applicable collective bargaining agreement or extension order can also be imported into an employment contract.